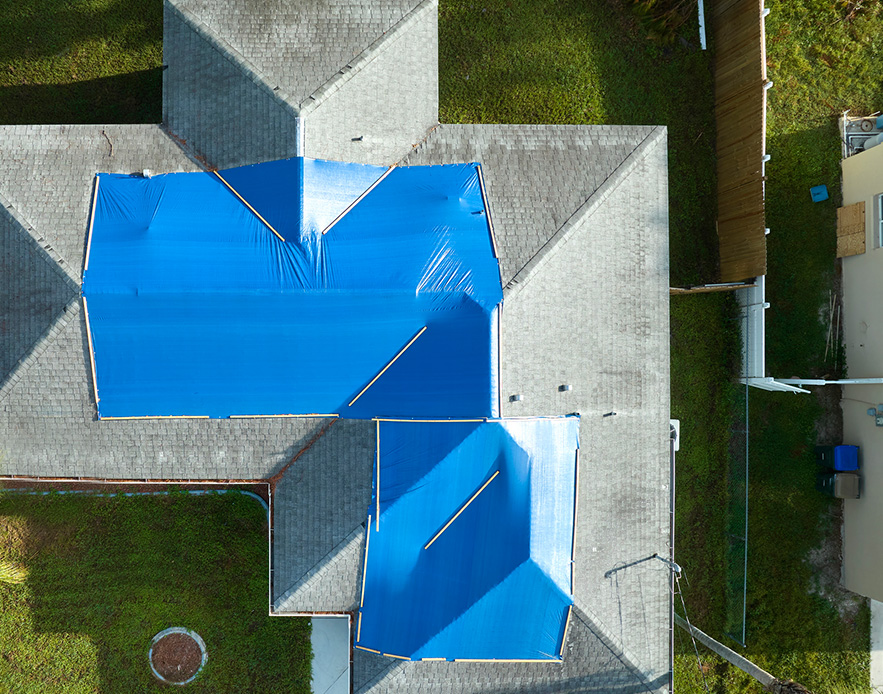

Preparing For a Roof Insurance Claim in Illinois

Has your roof been damaged by a recent storm? Infinity Exteriors will guide you through the process of filing a roof insurance claim and getting your roof repaired or replaced. Here are 6 key steps to prepare for a roof insurance claim in Illinois

- Document the damage:

Take plenty of photos and videos as evidence for your insurance claim.

- Get a roof inspection:

We’ll assess the damage and provide a free estimate for repair or replacement.

- File an insurance claim:

File a claim with your insurance company if repairs will exceed your deductible - we’ll help you through the process!

- Meet with the claims adjuster:

Meet with the adjuster to get a coverage quote. We’ll work with your insurance company to get the most coverage possible.

- Hire a roofer:

Contact Infinity Exteriors for a smooth, hassle-free roof repair or replacement.

- Pay only your deductible:

After hiring Infinity, you’ll only need to pay your insurance deductible; your insurance provider will cover all other approved costs.

Dealing with roof storm damage can be stressful, but with Infinity Exteriors by your side, we'll simplify the insurance claim process and restore your roof to its pre-storm state. Don't face it alone – reach out to us today to begin the process!

For Insurance Claim Assistance?

For Insurance Claim Assistance?